Table of Contents

Two pieces of Florida legislation, which have been effective since July 2025 (CS/SB 1674 and CS/CS/HB 669), modify policies for local governments—removing minimum bond ratings for Israeli bond investments.

These policy modifications enable local governments to invest virtually limitless sums to the Israeli war effort, despite the mounting financial risk of doing so.

Bonds are fixed-income securities purchased by investors to lend money to the government, which is repaid over a long period. Typically ranging from two to fifteen years at a predetermined interest rate. Proceeds from these bonds would return to Israel as a surplus budgetary fund for government projects, that includes the costs associated with its military campaigns.

Florida, like most states, historically had tight reigns on local government investments — pushing for safe, risk adverse investments that would avoid wasting tax-payer money. These investments normally included US treasury bonds, government-backed securities, and insured deposit. With the primary goal being: preserve capital and avoid exposing public funds to speculative risk.

Israeli bonds, overseen by a chair appointed by Israel's finance minister, functioned as a quasi-sovereign financing mechanism in its formative years.

The bonds, marketed to diaspora Jews and Americans, became a fiscal instrument during the Six-Day War in 1967 and the Yom Kippur War in 1973. Blurring the lines between private investment and state-backed war financing, the program transformed diaspora finance into an extension of Israeli military strategy while embedding US investors in the political economy of conflict.

Is there cause for concern in allowing unrestricted U.S. Government investments into a foreign country on the brink of regional war?

Prohibiting financial-risk standards on public investments to any foreign government bond effectively shields them from market accountability in the event of the collapse of fiscal stability. Major rating agencies have already flagged these particular Israeli bonds as being at risk of default.

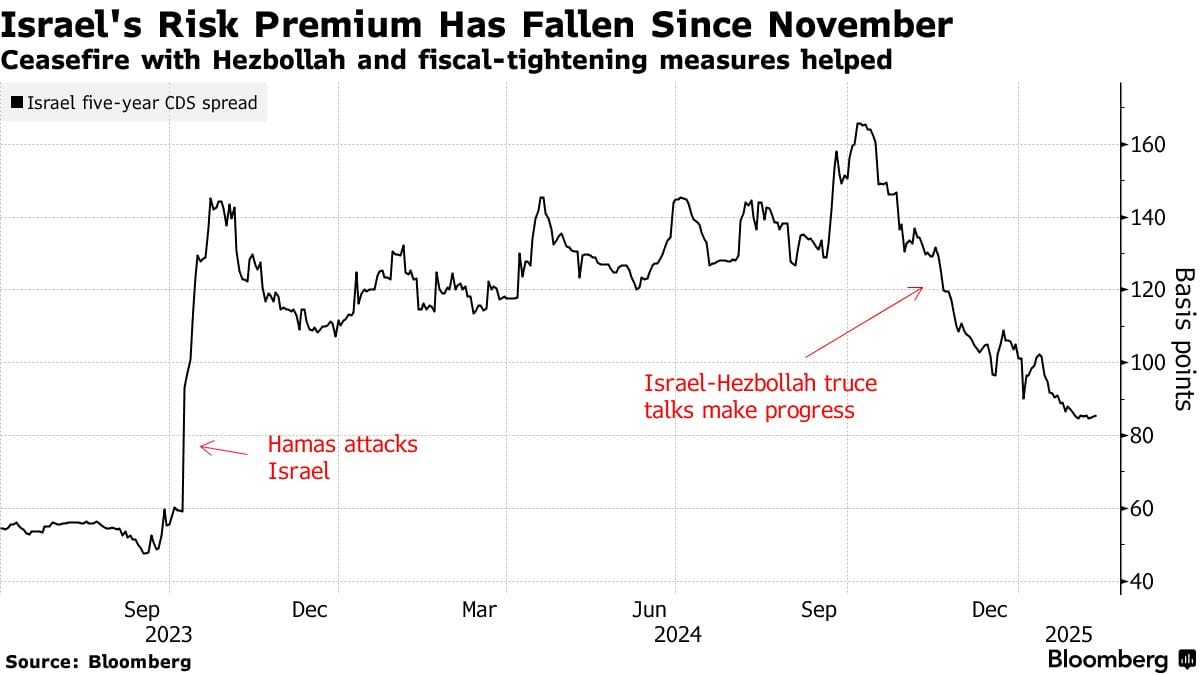

Wall Street's leading credit assessor, Moody's, dropped Israel's rating from "A" to "Baa", warning of an imminent drop as a result of the country's deepening geopolitical turmoil.

Additional rating agencies like Fitch and S&P global also lowered their rating, siding, the prolonged war in Gaza and the risk of military escalation with Iran.

Since the beginning of the Israel-Hamas War, Israel has relied on $5 billion in US financing to cover its growing debt. American taxpayers have been indirectly covering $1.7 billion of that through state and local government investments.

Palm Beach County, the home base of President Trump's estate, Mar-a-Lago, is currently facing a lawsuit from its residents for sinking 15% of its savings portfolio into debt-issued Israeli bonds. This makes Palm Beach county the world's largest investor in Israeli bonds. Under current Florida law (Florida Statutes §(17)), "State of Israel Bonds" are the only foreign government securities that municipalities, counties, and other local entities are permitted to purchase.

Florida local entrepreneur and political activist, Ian Smith says his concern is that local taxpayers, "can and will be left holding the bag with no domestic services at home."

"This isn't just sloppy investing; it's shady politics. It's shady backroom politics, and it can and will affect you directly. These are your taxpayer dollars being put at risk, used to send a political message while stripping away the financial guardrails that these things are specifically for."

While states like Florida, Pennsylvania, New York and Arkansas have enabled state and local government to invest public funds in Israeli bonds, many other states have taken action to freeze and/or end their purchases of Israeli bonds.

Countering the financial concerns, The Organisation for Economic Co-operation and Development (OECD) has noted that growth drivers such as high-tech sector, currency export base, and monetary policies has enabled Israel to keep their economy on a stable footing.

Economic surveys by OECD forecasts that the country’s economy will grow at a rate of 3.4 percent in 2025 and 5.5% in 2026, which is faster than the organization’s average growth forecast for the global economy of 3.1% in 2025 and 3% in 2026. However, the OECD’s 2025 growth forecast is still lower than the 4% projection by the Bank of Israel and the Finance Ministry.

While current Israeli bond ratings have not dropped past legally investable standards, and Florida has gained around $9.4 million in interest, is it morally or ethically justifiable to profit from investments that fund foreign military conflict without direct public consent?