Table of Contents

The American middle class, once the engine of prosperity, is being crushed by a yawning wealth gap that’s leaving millions behind. Stagnant wages, unaffordable homes, and relentless economic pressures are dismantling the dream of financial security.

At the center of this crisis is a disturbing trend: massive corporations and hedge funds are gobbling up single-family homes, turning a cornerstone of middle-class wealth into a profit-driven commodity.

Add in soaring healthcare costs, education debt, and job insecurity, and the middle class is fighting a losing battle against a system tilted toward the ultra-rich.

“The middle class has experienced much slower income growth than both the affluent and the poor,” said Richard Reeves, director of the Future of the Middle Class Initiative at the Brookings Institution.

A 2022 Pew Research Center report confirms this, showing the share of adults in middle-class households fell from 61% in 1971 to 50% in 2021, while upper-income households’ share of aggregate income jumped from 29% to 50%. Middle-class median income grew just 50% from 1970 to 2020, lagging the 69% surge for the wealthy.

“The median income of these households was 4% less than in 2000,” the report noted, marking a lost decade of progress.

Housing, the bedrock of middle-class stability, is under siege.

Corporate giants like BlackRock and Invitation Homes, backed by hedge funds, are buying up homes at a staggering pace, converting them into rentals and pricing out everyday buyers.

“The last thing Americans need is a Bezos-backed investment company further consolidating single-family homes and putting homeownership out of reach,” said Rep. Ro Khanna, slamming a Jeff Bezos-funded venture betting on rentals.

In cities like Atlanta and Phoenix, deep-pocket investors snagged 25% to 33% of homes in recent years, with private-equity firms sometimes buying “50 percent of the houses on a single street,” said Cincinnati housing expert Laura Brunner.

This corporate takeover fuels the wealth gap.

“Homeownership is not just about owning a home; it’s the best way to build future wealth,” said Jung Hyun Choi, a research associate at the Urban Institute.

Yet, median home prices in cities like San Francisco now top $1 million, locking out young families.

The National Association of Realtors reported homeownership rates dropped to 75.3% in 2024, down from 76.1% a decade earlier, as first-time buyers struggle.

Other pressures pile on. Healthcare costs have skyrocketed, with families shelling out $3,500 more in 2022 for basic goods and services than the prior year, per the Consumer Price Index.

Education, another pillar of middle-class success, is increasingly out of reach, with Millennials buried under $1.7 trillion in student debt. “I don’t have an asset that I can sleep in that makes more money than my daily labor,” said Abdalla, a middle-class worker quoted by TIME, contrasting his reality with his parents’ homeownership wealth.

Retirement security is fading, too, with half of U.S. households at risk of insufficient savings as employers ditch pensions for 401(k)s. “Saving for retirement has become much more difficult,” a 2014 Center for American Progress report stated.

Corporate practices worsen the squeeze. Private equity firms, controlling 11% of U.S. nursing homes and 40% of emergency departments, prioritize profits, cutting jobs and hiking costs.

“The push for profits is absolutely immense,” said financial journalist Gretchen Morgenson, describing how firms like KKR and Blackstone drive up medical bills.

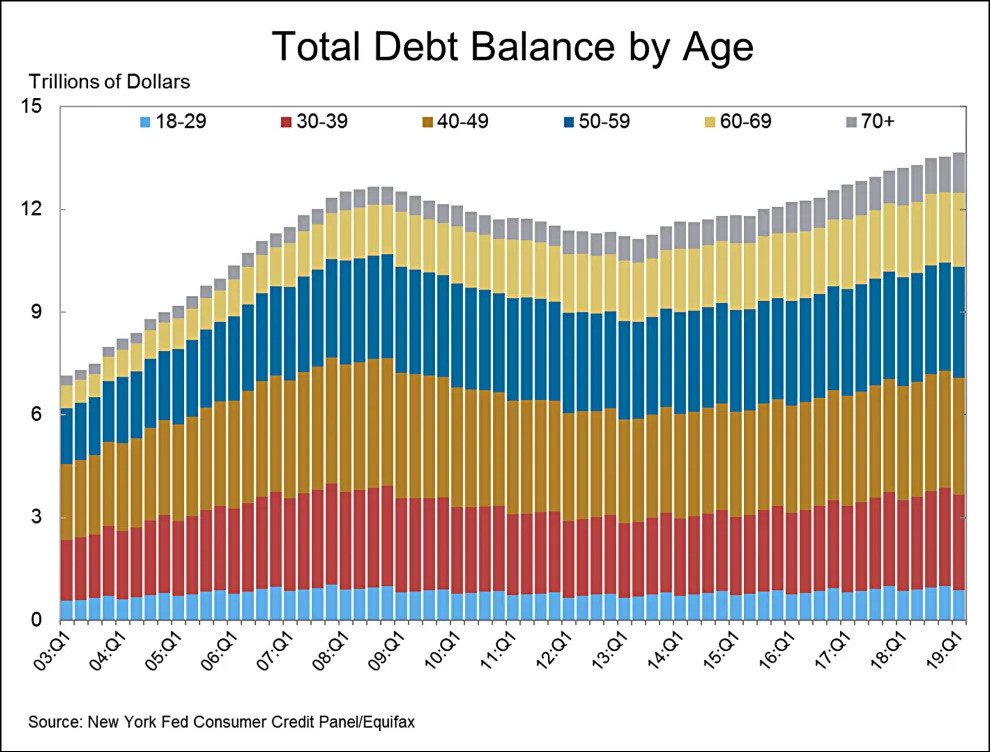

The top 1% held $35.8 trillion in wealth in 2022, over eight times the bottom quintile, while the middle class’s share shrank from 37% to 26% since 1990, per Federal Reserve data.

Policy solutions offer hope. “Homeownership benefits households and society,” said economist Daniel Waldenstrom, advocating for expanded mortgage access and affordable housing.

The End Hedge Fund Control of American Homes Act, which would force firms to sell off homes, aims to reclaim the market for families.

“We need to get rid of policies that allow parents to give their children an unfair advantage,” philosopher Adam Swift said, pushing for fairer systems. Until these changes take hold, the middle class remains trapped in a system where wealth fuels wealth, and the American Dream slips further away.

Please leave your opinions / comments on these stories below, we appreciate your perspective!